A weekly wrap up of interesting news about virtual worlds, virtual goods and other social media.

A contentious battle over Internet anti-piracy legislation shifted from Washington to the Consumer Electronics Show, The Washington Post reported. The Consumer Electronics Association, which is behind the show, has been a vocal opponent of the two bills circulating in Congress that would help Hollywood titans, record labels and pharmaceutical firms enforce copyright infringement laws online.

Mobile virtual currency market to hit $4.8bn by 2016

In fact, a study released yesterday from Juniper Research predicts that the amount of money being spent on virtual currency in mobile apps is going to more than double in the next four years, going from $2.1bn last year to $4.8bn by 2016.

Bethesda Buys Interplay’s ‘Fallout’ Rights, Ends IP Suit

Interplay Entertainment Corp., original developer of the “Fallout” line of video games, on Monday forfeited its rights to continue work on the series — resolving a trademark dispute with former business partner Bethesda Softworks LLC.

Domino’s Pizza uses augmented reality offers to boost food sales

Domino’s Pizza, which has already been testing the waters of mobile marketing for some time now, has started a new campaign that includes the use of augmented reality, to add a whole new dimension to its latest 555 pizza offer.

CES: Better augmented reality with high-tech contact lenses

Augmented reality has made progress on smartphones, with apps letting people layer information and graphics over a view of the real world. A startup from the Seattle region is looking to take the next step toward an AR future with special contact lenses that make it possible to view objects projected onto glasses a short distance away from the eye.

Banks start playing games with your money

A new video game has gotten its hooks into Brian Kealer, a 26-year-old San Francisco software engineer. He’s not killing birds or using his vocabulary to impress his friends. No, Kealer is after real prizes, like the iPad2 he just scored. And he’s playing with his bank account.

8K69Q43F7MWC

Internet & Social Media Law Blog

Internet & Social Media Law Blog

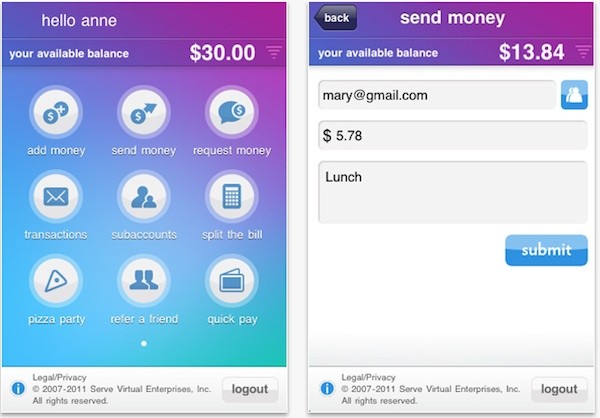

American Express has partnered with Zynga to allow American Express

American Express has partnered with Zynga to allow American Express