A great video by Socialnomics on where social media is and where its going.

Virtual Property Insurance

Many people invest significant time, effort and in some cases real money to acquire virtual goods. There is great perceived value in these virtual goods. But there are a growing number of cases, where users have been the subject of hacking and other situations where they have had their virtual property stolen. See for example our prior blog entry on a massive theft of 400 billion poker chips from Zynga users.

Most game and virtual world operators try to shield themselves from claims of loss by their users through effective legal strategies embodied in their terms of service. In most cases, users are only granted a license to use the virtual goods, but they do not own them and the terms often make clear that there is no independent value to goods. Additional disclaimers and liability avoidance language may also be included. Yet, this has not stopped some users from suing for the loss of the perceived value of their virtual goods.

Given these potential claims, what else can companies do to protect themselves from such risks? Apparently, this risk may now be insurable – at least in China – thanks to a collaboration between Sunshine Insurance Group and Gamebar. According to a report, by China Daily a Sunshine Insurance spokesperson said “The insurance will help to reduce operating risks for online games

companies as the companies which purchase the insurance will be covered

to compensate customers in the event of lost or stolen property.”

It will be interesting to see if that catches on in the US and elsewhere, and if so, what will be covered and what will not. Check back for updates.

Supreme Court Affirms Decision in Brown v. EMA

The Supreme Court of the United States issued a long-awaited decision in Brown v. EMA. The decision authored by Justice Scalia (in which Justices Kennedy, Ginsburg, Sotomayor and Kagen joined and Alito and Roberts concurred) opined on the validity of California Assembly Bill 1179 (2005), Cal.

Civ. Code Ann. §§1746-1746.5 (“Act”). The Act prohibited the sale or rental of violent video games to minors and required packaging to be labeled ‘”18″ if the game included options for “killing,

maiming, dismembering, or sexually assaulting an image of a human being”

in ways that reasonably could be considered as appealing to “a deviant or morbid interest of minors” or is “patently offensive to prevailing standards in the community”.

The Supreme Court strongly held that video games qualify for First Amendment protection and that the “basic principals of freedom of speech . . . do not vary” with the creation of a new and different communication medium. Specifically, the Court stated that “[l]ike the protected books, plays, and movies that preceded them, video games communicate ideas — and even social messages — through many familiar literary devices (such as characters, dialogue, plot and music) and through features distinctive to the medium (such as the player’s interaction with the virtual world). That suffices to confer First Amendment Protection.” The decision stated that the First Amendment protection is subject to only a few limited exceptions for historically unprotected speech, such as obscenity, incitement and fighting words and a legislature may not create new categories simply by deciding that such categories of speech do not have sufficient societal value. Moreover, the Court’s decision stuck down the proffered argument that violence is a form of obscenity by holding that “[v]iolence is not part of obscenity that the Constitution permits to be regulated”.

The court did not remove the possibility of any sort of video game regulation and clearly understood California’s desire to protect its minor citizens. “No doubt a State possesses legitimate power to protect children from harm . . . but that does not include a free-floating power to restrict the ideas to which children may be exposed.” The Court found that if California could actually demonstrate that its Act passes the strict scrutiny test (i.e. justified by a compelling governmental interest and is narrowly tailored to serve said interest) it may be able to restrict the protected speech inherent in video games. However, the Court opined that California could not meet this standard as its evidential psychological studies were flawed and its Act is “widely underinclusive” raising concerns that it is merely disfavoring a certain viewpoint rather than protecting a valid state interest.

“Here, California has singled out the purveyors of video games for disfavored treatment — at least when compared to booksellers,

cartoonists, and movie producers — and has given no persuasive reason why.” Therefore, the Court felt that by limiting its purported regulation to the video game industry while ignoring other industries that make violent content available to minors, California demonstrated a unconstitutional bias. Moreover, the court stated that the video game industry’s ESRB voluntary rating system already accomplishes one of the Act’s goals, that of assisting parents in restricting their children’s access to violent video games eliminating the compelling need for California’s Act.

While the Court’s decision did not put a final nail in the coffin of any future laws seeking to regulate video game content,

it did make it significantly more difficult to do so without meeting the strict scrutiny standard.

Canadian Privacy Commissioner to Tech Companies: “Think about privacy before you launch a new application; don’t just leave it to luck and the lawyers.”

On June 21, Canada’s Federal Office of Privacy Commissioner released its 2010 annual report on Canada’s data privacy law, the Personal Information Protection and Electronic Documents Act (known as “PIPEDA”). According to the report, in 2010 the Office of the Privacy Commissioner:

§ Received 4,793 inquiries in 2010 under PIPEDA,

§ Received 108 “early resolution” complaints of violations,

§ Received 99 formal complaints of violations, and

§ Closed a total of 249 investigations into formal PIPEDA complaints.

Among other things, the Report states, “Social media networks, which some research suggests now link together more than half of all Canadian Internet users, were of particularly pressing interest to our Office.” This is consistent with similar statements that have been made by the UK Information Commissioner’s Office, and should indicate to any game or social media company with global ambitions that the days of flying under the radar of data protection authorities are coming to an end.

The Report includes discussion of the Office of Privacy Commissioner’s investigations into the privacy practices of Facebook and issues around the launch of Google Buzz and Google’s well-known street-view wifi data collection practice. The Report also covers a previously unreported investigation of online dating site eHarmony’s privacy practices. The investigation was prompted by a complaint by an eHarmony member. According to the Report, when she requested to delete her online account after her membership ended, eHarmony’s response was to tell her that her account was inaccessible to other members, but that the personal information could not be entirely removed.

The Privacy Commissioner found that the option to “close” an account was not readily accessible on the eHarmony website, and that the website did not provide a clear explanation of what eHarmony meant by the term “close the account.” Based on recommendations from the Office of Privacy Commissioner, eHarmony is establishing a two-year retention period for personal information collected from its users, providing a “clear and efficient process” for users to request removal of their personal information, and providing users with “clear information” on the difference between deactivating and deleting an account and on its personal information retention policy.

It’s important to note that the Report stressed that the office’s interest in the privacy practices of online dating sites is not restricted to eHarmony. The Report noted that other dating sites do not have privacy policies at all and others have policies but do not specify how they handle personal information after a user is no longer active.

The fact that the Privacy Commissioner felt the need to note that some websites do not have privacy policies is somewhat shocking. Since July 1, 2004, it has been a violation of the California Online Privacy Protection Act (OPPA) of 2003 to fail to post a conspicuous privacy policy on any commercial website that collects personal information about California residents.

The 132-page 2010 annual report is available at http://www.priv.gc.ca/information/ar/201011/2010_pipeda_e.pdf.

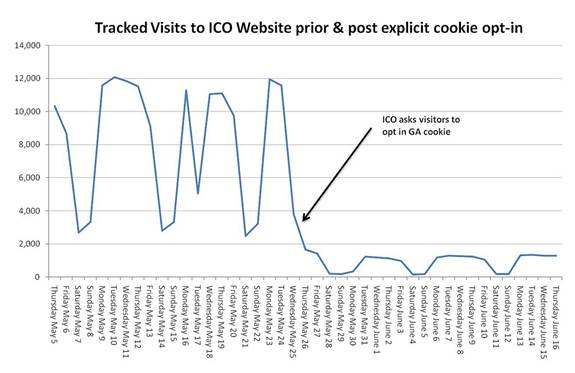

Data on the Effect of the EU Cookie Rule

The EU “Cookie Rule,” which requires companies with European customers to get informed consent from visitors to their websites in order to use most cookies (other than those “strictly necessary” for the service requested by the consumer), went into effect on May 25. As an example of how they wanted websites to behave, the UK Information Commissioner’s Office put the following banner on their website:

Thanks to a Freedom of Information request from Vicky Brock, we can see the effect of the opt-in cookie requirement on tracked traffic to the ICO website:

Vicky has also made the underlying data available in a Google Docs spreadsheet.

While this does seem to pose a challenge for marketers, there are a couple of things about this data to keep in mind:

1) The UK ICO implemented the opt-in via a banner on the top of the page. People have grown so used to ignoring banners that they might not have even looked at the option being provided. Thus, another method for requesting consent might have a greater opt-in rate. Guidance from the UK ICO states that consent can be obtained via the following methods:

- Pop-ups. A website operator could ask a user directly if they agree to a website operator putting something on their computer and if they click “yes”, this would constitute consent.

- Terms and conditions. A website operator could alternatively make users aware of the use of cookies via the terms and conditions, asking a user to tick a box to indicate that they consent to the new terms.

- Settings-led consent. Consent could also be gained as part of the process by which the user confirms what they want to do or how they want the website to work, e.g., some websites “remember”

which language version of a website a user prefers. If this feature is enabled by the storage of a cookie, then the website operator could explain this to the user and that it will not ask the user every time they visit the website.

It is worth noting, however, that the guidance does not purport to be exhaustive. The ICO states that they will consider supplementing the advice with further examples of how to gain consent for particular types of cookies in the future. It goes on to say that the examples listed are not intended to be a prescriptive list on how to comply,

rather, that a website operator is best placed to work out how to get information to users and what users will understand. Each case will be facts-specific.

2)

Even for those who did see the banner, there isn’t really any incentive to opting-in. If a website makes a case for the opt-in by pointing out additional functionality or other benefits to opting-in, that may increase the opt-in rate.

Another issue for websites is that it is not yet clear whether the Cookie Rule applies to non-cookie tracking technologies like web beacons. Technically, the Cookie Rule applies to “the storing of information, or the gaining of access to information already stored, in the terminal equipment of a subscriber or user.” However, given the assertive position that many European Data Protection Authorities take towards the protection of personal information, it may be prudent to assume that anything that lets a website track users could require consent. In the case of web beacons, as well, since they could disclose a users IP address, which could be personally indentifying information, they might be subject to the general obligation to obtain user consent before collecting personal information,

anyway.

Massachusetts Department Of Revenue Issues Letter Ruling Holding Certain On-Line Services Not Subject To Sales Or Use Tax

On April 12, 2011, the Massachusetts Department of Revenue issued Letter Ruling 11-4 holding that a product providing a customer access to information from a Taxpayer’s database is not subject to sales or use tax where the services provided do not involve transfers of prewritten software or a license to use software on a server hosted by the Taxpayer or a third party.

The Massachusetts Department of Revenue (“DOR”) issued Letter Ruling 11-4 addressing the issue of whether Massachusetts customers of a Taxpayer’s product, which provides employment application collection and selection services through proprietary software, are subject to Massachusetts sales and use tax. The DOR held that sales of the taxpayer’s products to Massachusetts customers are not subject to the Massachusetts sales and use tax. Massachusetts imposes a 6.25% sales tax on sales of tangible personal property and telecommunication services within the state including sales of prewritten (canned) software regardless of the method of delivery. Also, the sale of a license or right to use software on a server hosted by a taxpayer or third party is taxable. However, where there is no charge for the use of the software and the object of the transaction is acquiring the good or service other than the use of the software, sales or use tax on software does not apply. See 830 CMR 64H.1.3(14)(a); LR 10-1. In the instant matter, the provision of information services to customers based on data gathered from prospective employees and provided in a report by a taxpayer to its customers is not subject to tax. The object of the customer’s purchase of the product is to obtain database access including reports prepared by the taxpayer, rather than use of the software itself. The taxpayer customers do not have the ability to operate, direct, or control the software. The DOR concluded that the services provided by the taxpayer do not involve transfers of prewritten software or a license to use software on a server hosted by taxpayer or a third party and therefore are not subject to sales and use tax.

The taxation of on-line services is evolving in many jurisdictions. Jurisdictions without specific statutory or regulatory authority addressing such services look to existing provisions for information, telecommunication, data processing or software services in attempts to include some on-line services within their scope. As the above ruling indicates, under existing sales and use tax principles such as true object of the transaction or primary purpose tests such efforts may not succeed. However, every jurisdiction has is own statutory provisions and tests so one needs to review them in the context of the specific facts relating to the online game or other social media services.

Did Zynga Create the Farm(ville)…or Steal It?

A recent lawsuit by SocialApps LLC (d/b/a take(5) social and playSocial) accuses Zynga of copyright infringement, theft of trade secret and various other acts concerning Farmville. Farmville is one of the most widely played and profitable social games, with around 80 million users and was released in June 2009. SocialApps allegedly developed and released “myFarm” in November 2008.

Did Zynga independently create Farmville or, as SocialApps alleges, did Zynga approach SocialApps using a ruse of due diligence in an attempt to acquire the IP rights and source code to get access to the details of myFarm?

Perhaps we will learn the answer as the suit progresses.

If SocialApps did indeed invent the game earlier, did they do all they could to protect the IP? Many companies in the online social game space do not.

For an overview of some of the ways that social game companies can protect their IP, see our previous post entitled “What You Don’t Know About IP Protection For Social Games Can Hurt You“.

What You Don’t Know About IP Protection For Social Games Can Hurt You

Copying within the games industry is prevalent. Some people attribute this to the fact that this is just the way it is and has always been within the industry. This is often premised on the notion that the “idea” for a game is not protectable. But as the game market grows, so to do the losses from copying suffered by the game innovators.

One of the biggest factors contributing to this is that many game developers do not develop comprehensive strategies for protecting the valuable intellectual property that they create. This is generally due to several reasons. One is that historically, intellectual property has just not been a big focus for many in the industry. The other is that many people are not aware of the range of options available for protecting IP in the game space and what aspects of games are protectable. This is often due to some common misunderstandings about intellectual property, particularly with respect to the patentability of game features.

While it is true that one can not protect the “idea”

for a game, this does not end the inquiry. Many aspects of games are protectable by patents, copyright and trademarks. Of these, patents are probably the most overlooked and least understood. While this applies to all types of games, there are particularly compelling opportunities to patent many of the innovative aspects of social and online games. This is due in part to the many recent developments in the relevant technology and business models for these games. Prudent developers and publishers will seize these opportunities to develop a comprehensive IP protection strategy.

Viacom Fighting to Knock YouTube’s Ship Out of Its Safe Harbor

As we previously posted, Viacom is appealing to the Second Circuit its summary judgment loss to YouTube (and its parent Google) of a billion-dollar copyright infringement suit. Last June, the U.S. District Court for the Southern District of New York ruled that YouTube is entitled to safe harbor protection under the Digital Millennium Copyright Act (“DMCA”) and granted YouTube’s motion for summary judgment on the basis that it did not have sufficient notice of the specific infringements at issue.

At the crux of the court’s decision was “whether the statutory phrases ‘actual knowledge that the material or an activity using the material on the system or network is infringing,’ and ‘facts or circumstances from which infringing activity is apparent'” in 17 U.S.C. § 512(c)(1)(A)(i) and (ii) mean “a general awareness that there are infringements” as argued by Viacom, or instead mean “actual or constructive knowledge of specific and identifiable infringements of individual items,” as argued by YouTube. The court agreed with YouTube’s interpretation, ruling it was supported by both the DMCA’s legislative history and recent case law.

Both sides have submitted their appellate briefs, and the Second Circuit has received 28 briefs filed by amici curiae. Oral argument will likely be scheduled between late August and late September.

Are you Game? GameStop and Virgin Gaming Form Tournament Partnership

On of the announcements

coming out of E3 is that GameStop and Virgin Gaming have formed a partnership to power online video gaming tournaments. According to the announcement, Virgin Gaming will be:

The preferred online tournament provider for featured console game releases sold in U.S.

GameStop locations and through GameStop.com. GameStop will offer publisher partners unique, large-scale online tournaments to help market, sell and create deep player engagement for their games. GameStop customers will have the opportunity to win cash and incredible prize packages through the GameStop/Virgin Gaming tournaments, in addition to Virgin Gaming credits redeemable for games and other merchandise.

As online gaming continues to grow, companies are seeking various ways to create ancillary revenue and drive user engagement. Tournaments can be one way of doing that. Tournaments, if done right, can be legal. However, there are a number of legal considerations of which companies must be aware to avoid running afoul of various laws.